AI Summary

Anthropic has launched "Claude for Financial Services," its first industry-specific AI solution, aiming to revolutionize how financial professionals conduct research, build models, and make investment decisions. This AI, integrating with major financial data providers like FactSet and S&P Global, enables analysts to synthesize information and generate comprehensive reports much faster, with early adopters like Norway's sovereign wealth fund reporting significant productivity gains (20% or 213,000 hours saved annually) and AIG improving underwriting accuracy from 75% to 90%.

The lights were still on at 3 AM in countless financial offices across Manhattan last week, but something fundamental was about to change. Analysts hunched over spreadsheets with their fifth cup of coffee, frantically debugging models before dawn client calls, might soon find themselves working very differently.

At a packed presentation in New York, Anthropic unveiled

Claude for Financial Services, marking the company's first industry-specific AI solution designed explicitly for the complex world of finance. The announcement represents more than just another enterprise software launch. It signals a potential transformation in how financial professionals conduct research, build models, and make investment decisions.

The Promise of AI-Powered Finance

Kate Jensen, Anthropic's head of revenue, painted a vivid picture familiar to many in the finance world: "You're three coffees deep. It's 3 AM. You're furiously checking that last model. You have 100 tabs open. You have a 5 AM prep call ready for a 6 AM client call." This grueling reality of financial analysis, she argued, is about to become obsolete.

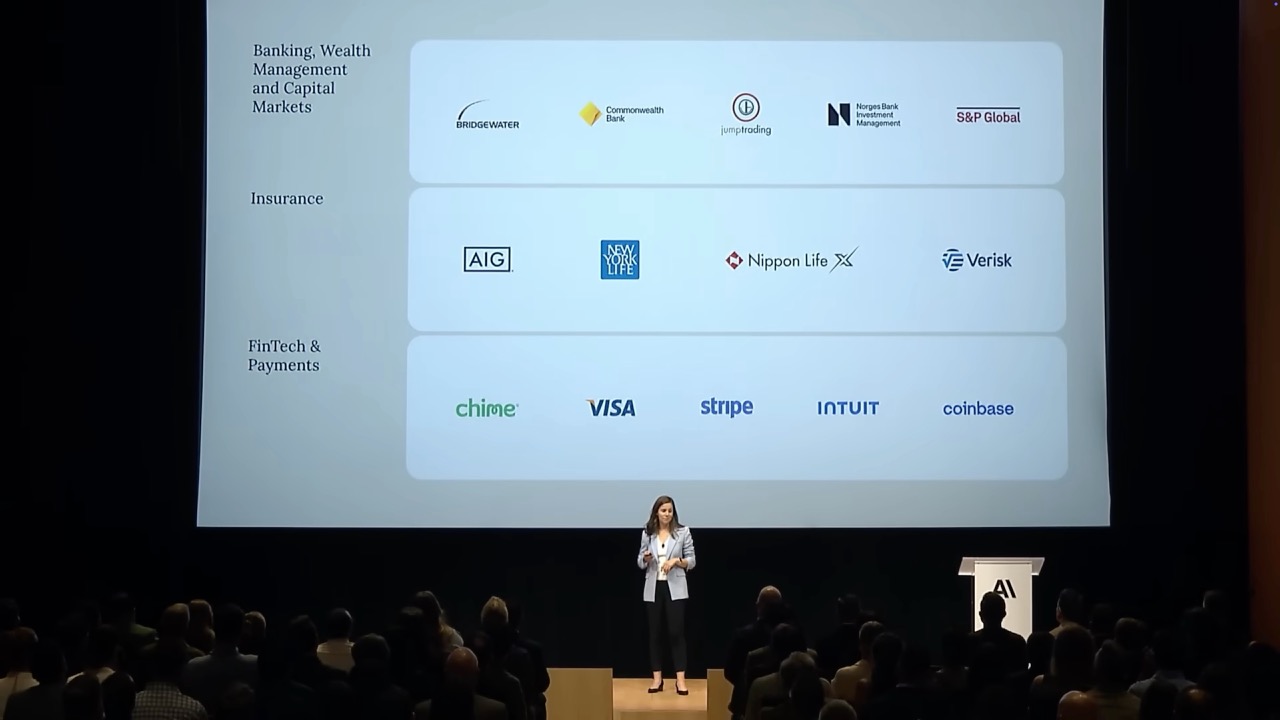

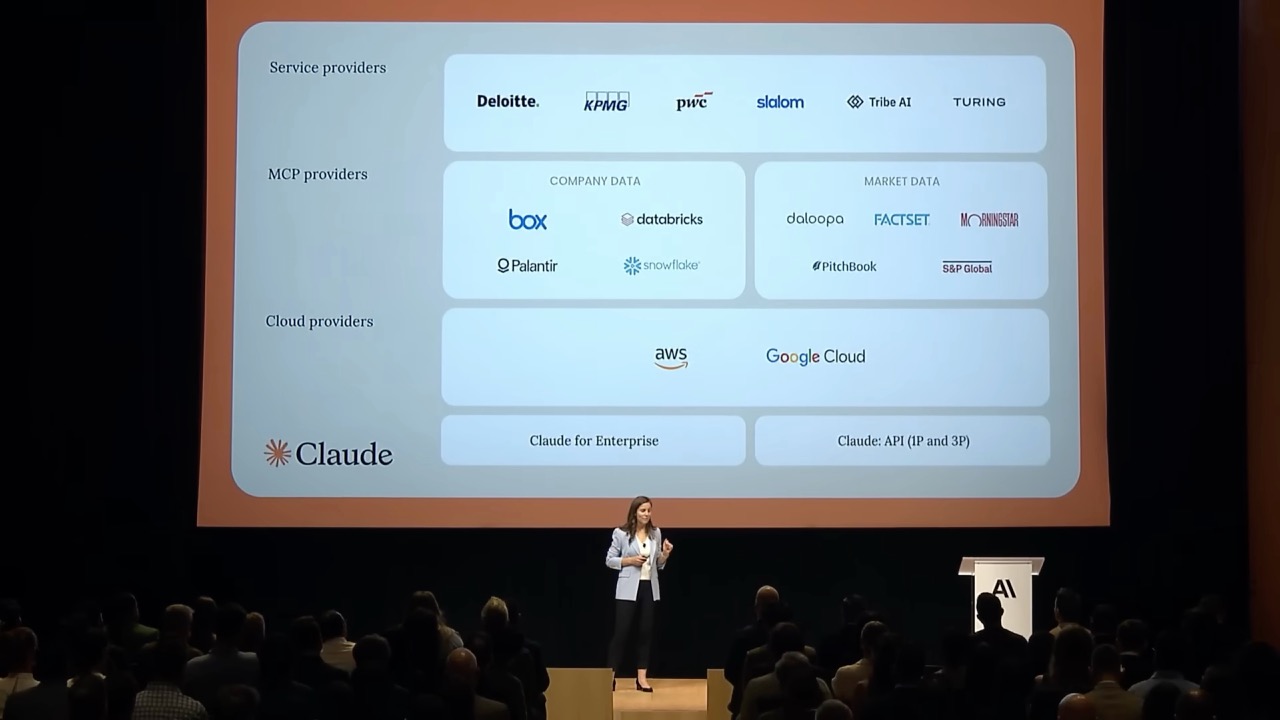

The solution Anthropic introduced isn't just a chatbot for finance. It's what the company calls "the industry's first unified intelligence layer" that connects directly to critical financial data sources. Through partnerships with established providers like FactSet, S&P Global, Morningstar, and PitchBook, Claude can now access real-time market data, company financials, and research reports all within a single interface.

The integration goes beyond simple data access. During a live demonstration, the system showed how an analyst could query multiple data sources simultaneously, synthesize information across platforms, and generate comprehensive investment memos in under 30 minutes. Tasks that typically require three to five hours of manual work across multiple browser tabs can now be completed with natural language queries.

Real-World Applications Already Showing Results

The announcement wasn't just theoretical. Several major financial institutions shared concrete results from their early adoption of Claude. Norway's sovereign wealth fund, the world's largest at $2 trillion in assets, reported 20% productivity gains equivalent to 213,000 hours saved annually. AIG demonstrated how their underwriting process, which previously took weeks, now completes in days with accuracy improving from 75% to 90%.

Peter Lusardi from Kensho Technologies, S&P Global's AI innovation hub, emphasized how the conversation around AI adoption has fundamentally shifted. "I've spent the better part of the last decade trying to get financial services companies to adopt AI," he explained. "In the world of generative AI, that conversation is very different. It's now 'how can you serve us as quickly as possible?'"

The speed of adoption has surprised even industry veterans. Financial institutions that once approached AI cautiously are now racing to implement solutions at scale. This urgency stems partly from competitive pressure, as Jensen noted that the industry is bifurcating into "two types of investment firms: those using AI institutionally and those who are losing their top talent to competitors who are."

The Technical Foundation

Behind the marketing promises lies substantial technical infrastructure. Claude for Financial Services is built on three core pillars: advanced AI models specifically trained for finance, agent capabilities that can perform complex tasks, and enterprise-grade security and compliance features.

The AI models have been trained specifically for financial domain knowledge, excelling at tasks like large-scale data analysis, financial reasoning, and even Excel manipulation. In independent benchmarks, Claude consistently outperformed competitors on financial reasoning tasks. One partner, Fundamental Labs, built an Excel agent using Claude that passed five out of seven levels of the financial modeling World Cup competition with over 83% accuracy.

The system's agent capabilities go beyond simple question-answering. Claude can build multimodal reports including pitch decks and investment memos, analyze and visualize data through charts and benchmarking analyses, and directly read and write Excel and PowerPoint documents. These expanded capabilities are now available in research preview for select customers.

Industry Leaders Weigh In

During a panel discussion, senior executives from major financial institutions shared insights from their AI adoption journeys. Michael from DE Shaw emphasized the importance of bottom-up innovation: "Your colleagues will discover things to do with these tools that you never imagined. So get really easy-to-use tools out there. Let people figure out what they're doing."

Don Vu from New York Life stressed that successful AI adoption requires more than just deploying tools. "It's a true mindset and culture shift," he explained. "A lot of people look at Claude, see a text box, and think 'oh this is like Google.' But this technology is really designed to be more like a human companion and co-pilot."

Lloyd Hilton from HG Capital, which manages 50 portfolio companies, reported dramatic productivity gains: "On average across the portfolio, we're now measuring about 30% productivity gains in software engineering. We have some companies who have taken their development squads down from nine people to two people."

The Build vs. Buy Decision

One recurring theme in discussions with financial firms is whether to build AI solutions internally or partner with companies like Anthropic. The consensus among panel participants was clear: the pace of AI development makes building competitive with commercial solutions increasingly difficult.

"Resources aren't infinite and with great people comes big opportunity cost," noted DE Shaw's Michael. "What's different this time is the speed at which the technology is changing. To build and deploy at that speed and scale that some of what's being offered in the commercial market can provide is often somewhere between difficult and impossible internally."

New York Life's Don Vu agreed, explaining their decision to partner rather than build: "Companies like Anthropic are moving at such incredible velocity with respect to innovation. We wanted to ensure that our internal developers and engineers were focused on our most proprietary and specific organizational solutions."

Practical Implementation Strategies

For organizations considering AI adoption, the panel offered concrete advice. Rather than starting with one specific use case, most recommended beginning with broad employee enablement. Give staff access to AI tools and let them discover applications organically, while paying attention to what works and helping accelerate successful implementations.

The Norwegian sovereign wealth fund's Frod emphasized starting immediately: "Move fast and make mistakes, learn from them and move on. If anything, it's just about speed." He noted that their organization's structure as a sovereign fund with a single owner allows them to implement AI more aggressively than institutions with complex stakeholder dynamics.

Regular revisiting of AI capabilities proves crucial as the technology evolves rapidly. Michael from DE Shaw recommended encouraging employees to re-examine AI tools every six months, as capabilities that might not have worked previously could dramatically improve in that timeframe.

The Cultural Transformation Challenge

Beyond technical implementation lies the larger challenge of cultural transformation. Financial services firms must navigate between innovation and risk management in a highly regulated industry. Success requires getting employees comfortable with AI as a collaborative tool rather than a replacement.

HG Capital addressed this by running immersive events where executives got hands-on experience with AI technology. "People find conviction at their own pace," Lloyd explained. "What really helped was getting people really hands-on and fully immersed in the AI topic."

The most successful implementations combine top-down leadership commitment with bottom-up experimentation. Norway's sovereign wealth fund benefits from having what Frod called "an AI maniac at the top of the fund" who drives cultural adaptation throughout the organization.

Security and Compliance Considerations

Financial institutions operate under strict regulatory requirements, making security and compliance critical factors in AI adoption. Anthropic addresses these concerns through SOC 2 Type 2 certification and a commitment not to train models on customer data by default.

The partnership with established financial data providers adds another layer of trust. Rather than requiring firms to share sensitive data with new vendors, Claude integrates with systems they already use and trust. This approach reduces compliance complexity while maintaining the data integrity that financial institutions require.

Cloud infrastructure partnerships with AWS and Google Cloud provide the scalable, secure foundation that financial institutions demand. Claude for Enterprise, including the financial services version, is now available on AWS Marketplace with Google Cloud Marketplace availability coming soon.

The announcement represents just the beginning of AI's integration into financial services. As the technology continues advancing at exponential rates, early adopters will likely gain significant competitive advantages. The firms showcasing results today started their AI journeys months or years ago, investing time in experimentation and cultural change before the technology fully matured.

Recent Posts