AI Summary

Companies are increasingly using AI to create synthetic customers for market research, simulating consumer responses with surprising accuracy, as highlighted by Harvard Business School research. This innovation allows for rapid and cost-effective testing of product concepts and pricing, fundamentally changing how companies approach innovation by enabling them to test many more variations before investing in human research. Fine-tuning these AI models with a company's proprietary historical customer data dramatically improves accuracy, providing a competitive advantage and suggesting a future where market research combines synthetic insights for broad exploration with targeted human research for validation and deeper understanding.

Imagine running a focus group where participants never show up late, always answer honestly, and cost virtually nothing to recruit. This isn't science fiction anymore. Companies are increasingly turning to artificial intelligence to create "synthetic customers" that can test product concepts, estimate pricing preferences, and flag potential failures before any real humans get involved.

Recent research from

Harvard Business School reveals that large language models like ChatGPT and Gemini can simulate consumer responses with surprising accuracy, producing insights that often mirror those of traditional human studies. While gen AI is already having a profound impact on marketing activities like customer service and content creation, it has the potential to be absolutely revolutionary in another area: market research.

The implications extend far beyond simple cost savings. This technology is fundamentally changing how companies approach innovation, allowing them to test dozens of product variations synthetically before investing in human research. But like any powerful tool, synthetic customers come with both remarkable capabilities and significant limitations.

The Technology Behind Digital Demographics

At its core, the concept works because large language models are trained on massive datasets that include product reviews, customer discussions, and behavioral patterns expressed in natural language. This training makes them surprisingly adept at responding to structured questions about consumer preferences.

Researchers have developed methods to directly prompt these models with product comparisons that mimic traditional market research surveys. For example, they might ask: "Would you buy a Colgate toothpaste with fluoride at $2.99 or a fluoride-free version at $1.99?" By repeating these queries across hundreds of randomized product configurations, they can generate distributions of simulated customer responses and estimate willingness to pay for different features.

The results have been remarkably consistent across multiple studies. In tests spanning categories like toothpaste, laptops, and tablets, synthetic customers valued familiar attributes like fluoride in toothpaste and additional RAM in computers in ways that closely matched human samples. The distribution of simulated responses captured important trade-offs between price and features, suggesting that AI models have absorbed nuanced consumer behavior patterns from their training data.

The Promise: Speed, Scale, and Smarter Innovation Funnels

Traditional conjoint studies, the gold standard for understanding consumer preferences, typically cost tens of thousands of dollars and take weeks to design, field, and analyze. AI-powered studies can run in hours at a fraction of the cost, generating thousands of simulated responses with rapid iteration capabilities.

This speed advantage enables a fundamentally different approach to innovation. Rather than developing a handful of ideas for testing, teams can now explore dozens or even hundreds of early concepts using synthetic consumers as a preliminary filter. According to

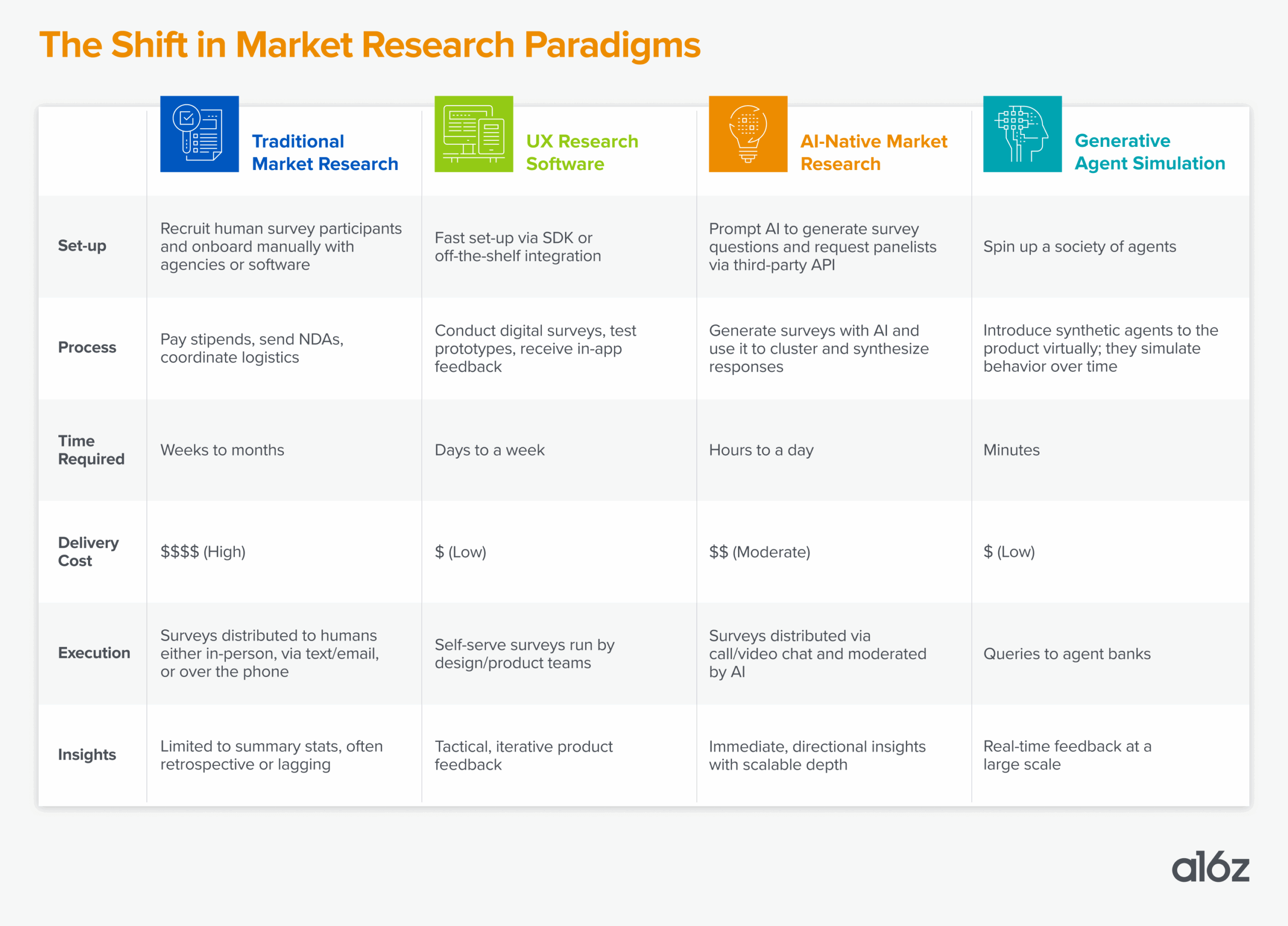

Andreessen Horowitz, AI-powered research tools are being used by many more users across a company's marketing, product, sales, and customer success teams, as well as leadership, expanding the reach of market research throughout organizations.

They are seeing a crop of AI research companies replace the expensive human survey and analysis process entirely. Instead of recruiting a panel of people and asking them what they think, these companies simulate entire societies of generative AI agents that can be queried, observed, and experimented with, modeling real human behavior. This turns market research from a lagging, one-time input into a continuous, dynamic advantage.

Consider the practical implications for a consumer goods company. They could test 40 new product variations synthetically, identify the 5 most promising concepts, and then invest human research resources only where they matter most. This approach expands the top of the innovation funnel while providing sharper data to narrow the bottom.

The technology also addresses some persistent challenges in traditional market research. Human panels can be difficult to recruit, especially for niche demographics. Response rates are declining across the industry. Researchers reported the top challenges were ensuring the quality of third-party panels and effectively identifying and preventing AI-generated responses in

recent surveys, highlighting how the research landscape is already being disrupted by AI.

The Reality Check: Where Synthetic Customers Fall Short

Despite these promising capabilities, off-the-shelf AI models aren't perfect simulators of human behavior. In fact, they tend to systematically overestimate interest in novel or unusual features. When researchers tested unconventional toothpaste flavors like "pancake" or "cucumber," synthetic consumers showed far more enthusiasm than actual people did.

This bias toward novelty reveals a fundamental limitation: without real-world consumer grounding, AI models lean toward curiosity and excitement, traits that don't always translate into actual purchasing decisions. Without real-world context, synthetic panels lack the nuances of human opinion.

The segmentation challenge is even more pronounced. When researchers prompted models with demographic modifiers like "you are a low-income shopper" or "you are a Republican," responses changed but often in inconsistent or exaggerated ways. In one study, the AI showed a $625 willingness-to-pay difference between Republicans and Democrats for Apple products, while the actual human difference was only $72.

These limitations mean that synthetic customers can approximate average market signals but struggle with segment-specific insights. For detailed demographic analysis or understanding cultural nuances, human research remains essential. According to a

recent research, its adoption includes challenges such as the need for rigorous validation, transparency and ethical considerations, particularly when dealing with sensitive demographic or cultural factors.

The Game Changer: Proprietary Data and Fine-Tuning

The most compelling finding in recent research is how dramatically AI performance improves when models are fine-tuned with a company's own historical customer data. This process involves adjusting model parameters based on past survey responses, teaching the AI to simulate that specific company's customer base more accurately.

The results can be transformative. In one example, researchers fine-tuned an AI model using responses from a toothpaste study with standard flavors like mint and cinnamon. When they then asked it to estimate preferences for new flavors like pancake and cucumber, the fine-tuned model reversed its earlier enthusiasm and produced much more realistic assessments that recognized most people find "pancake toothpaste" unappealing.

This pattern held across categories. After fine-tuning on laptop surveys covering features like screen size and RAM, AI models produced significantly more accurate willingness-to-pay estimates for entirely new features like built-in projectors compared to their base performance.

However, the fine-tuning effect appears category-specific. When researchers queried a model fine-tuned on laptop data about tablets, a related but distinct category, it actually performed worse than the off-the-shelf version.

This creates an intriguing competitive dynamic. Companies that invest in building and fine-tuning their own internal "customer simulators" using historical survey data can unlock sharper early-stage insights. Two firms using the same base AI model will get different outputs if one has trained it on their specific customer preferences, creating a new form of data-driven competitive advantage.

The Business Impact: Redefining Innovation Timelines

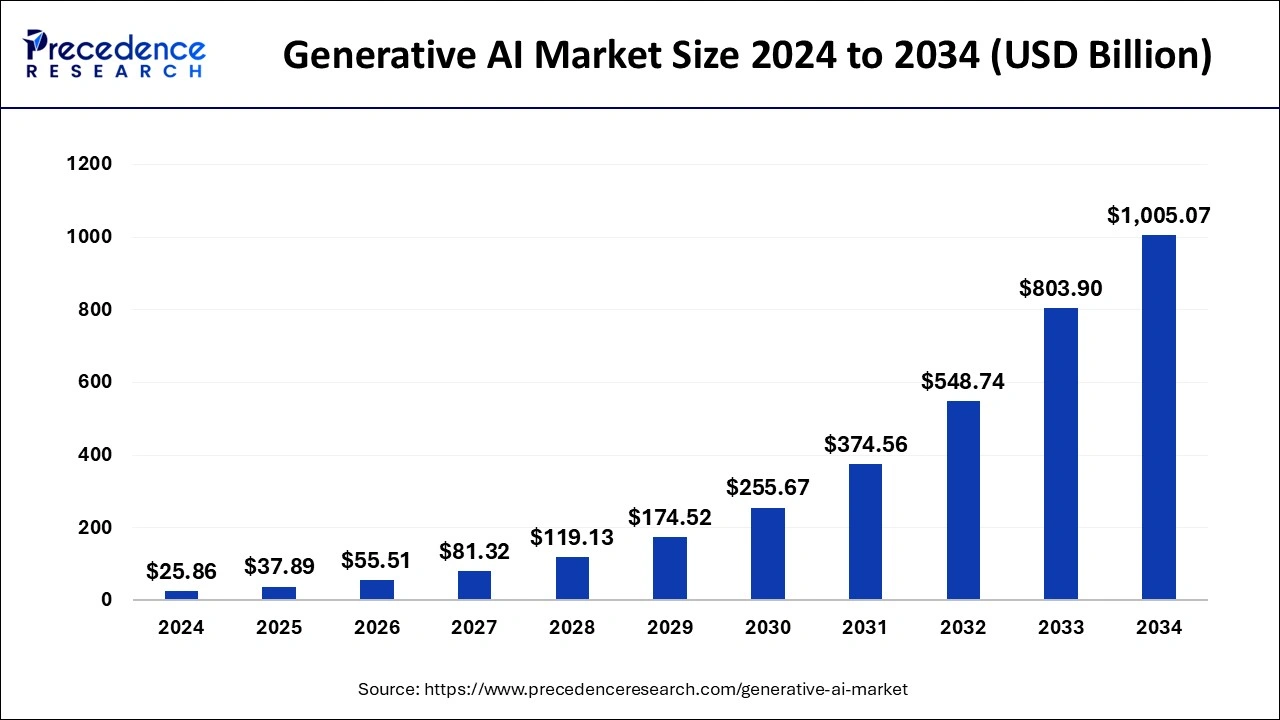

The market for AI-powered research tools is experiencing explosive growth. According to

Precedent Research, the generative AI market size was evaluated at USD 25.86 billion in 2024 and is projected to hit around USD 1005.07 billion by 2034 with a significant CAGR of 44.20%, with market research applications representing a growing share of this expansion.

Industry surveys reveal widespread adoption expectations. 72% expect AI to outperform human analysts in predicting market trends within three years, and 71% agree it will also equal human ability in explaining research findings, according to the

Qualtrics Report research. This confidence is driving investment across the research ecosystem.

Major consulting firms and technology companies are developing sophisticated synthetic customer platforms. From product design to campaign testing, companies are using synthetic customers to get sharper answers faster, as strategic consulting firms have noted in their latest market analysis.

Practical Implementation: Getting Started with Synthetic Customers

The technology works best as a funnel-expanding tool rather than a replacement for human insight. Companies should use it to explore more ideas quickly and cheaply, then apply traditional research methods to the most promising concepts. For companies considering this technology, the path forward involves several key considerations:

- Start with early-stage exploration: Use synthetic customers for initial concept testing and prioritization rather than final validation

- Focus on familiar attributes: AI performs best when evaluating well-understood product features rather than entirely novel concepts

- Invest in data collection: The most valuable implementations require historical customer data for fine-tuning

- Plan for human validation: Always follow synthetic insights with human research for final decision-making

- Expect category-specific performance: Models trained on one product category may not transfer effectively to others

Critical Challenges: Privacy, Bias, and the Human Element

As synthetic customer research becomes more prevalent, several important considerations emerge. Privacy concerns are paramount when using customer data to train AI models. Companies must ensure they have appropriate consent and data governance structures in place.

There's also the risk of perpetuating biases present in training data. If historical customer surveys contain demographic biases or cultural blind spots, fine-tuned models will likely amplify these issues. This makes diverse, representative training data essential.

The rapid pace of AI development creates additional challenges. Frequent updates to base models mean that companies need to continuously evaluate and recalibrate their synthetic customer systems, making it challenging to maintain consistency over time.

Perhaps most importantly, there's a risk that organizations might over-rely on synthetic insights and lose touch with the genuine complexity of human behavior. The technology should augment human understanding, not replace the nuanced judgment that comes from direct customer interaction.

The Road Ahead: Hybrid Intelligence in Market Research

The integration of synthetic customers into market research represents more than just a technological upgrade. It's enabling a fundamental shift in how companies approach innovation, moving from a scarcity mindset around customer insights to one of abundance.

This change is particularly significant for smaller companies and startups that previously couldn't afford extensive market research. AI-powered tools are democratizing access to consumer insights, potentially leveling the playing field between established corporations and nimble newcomers.

The technology is also enabling more iterative, agile approaches to product development. Instead of the traditional linear process of develop, test, launch, companies can now test continuously throughout development, making course corrections based on synthetic feedback before committing significant resources.

However, the future likely involves hybrid approaches rather than pure AI replacement. The most sophisticated research programs are already combining synthetic insights for broad exploration with targeted human research for validation and deeper understanding. As one researcher noted:

It's not about man versus machine, it's about using machines to listen more efficiently, so humans can make better decisions.

Recent Posts