AI Summary

The automotive industry is undergoing a significant transformation driven by advanced robotics, moving beyond traditional automation to incorporate AI-powered, vision-guided, and even humanoid robots. This shift is enabling virtual factory testing through "digital twins," fostering human-robot collaboration with "cobots," and aiming for increased efficiency and reduced labor costs, although fully "dark factories" remain a future aspiration. The global race in robotics, particularly between the US and China, highlights the immense economic stakes and the potential for new supply chain opportunities.

Walk into a modern automotive factory today, and you might feel like you've stepped into a science fiction movie. Robots glide autonomously across factory floors, their mechanical arms performing intricate dances as they weld, paint, and assemble vehicles with precision that would make human workers dizzy.

But this isn't your grandfather's automation. The robots revolutionizing auto manufacturing today are smarter, more flexible, and increasingly human-like. They're powered by artificial intelligence, guided by advanced vision systems, and in some cases, they're literally designed to walk and work alongside human colleagues.

The automotive industry has always been at the forefront of industrial automation, dating back to General Motors' deployment of the first industrial robot at a New Jersey assembly plant in 1961. Today, automakers installed a record 14,678 robots in 2023 alone, with 65 percent of automotive businesses now using robotics. But the current wave of innovation represents something fundamentally different from the fixed, single-purpose machines of the past.

The Digital Twin Revolution

One of the most significant changes happening behind the scenes involves how robots are designed and deployed. Traditional robot installation was a painstaking process of physical trial and error. Engineers would create factory layouts on paper, install equipment, then spend weeks tweaking everything to work in the real world.

Enter digital twins: virtual replicas of entire factory floors where engineers can test robot movements, optimize speeds, and identify potential problems before installing a single piece of hardware. Think of it as a video game version of your factory where you can experiment without consequences.

Mike Cicco, CEO of robot maker Fanuc America, describes the transformation:

You can obviously move things around easier in a virtual environment; you can test things easier in a virtual environment, and then once that's proven out, you can understand exactly how fast and where everything should go.

This virtual testing is saving manufacturers both time and money, allowing them to perfect their automation systems before committing to expensive physical installations.

Collaborative Robots Change the Game

The robots of yesterday were caged beasts - powerful, dangerous machines that required safety barriers to protect human workers. Today's collaborative robots, or "cobots," are designed to work safely alongside people, opening up entirely new possibilities for flexible manufacturing.

These smaller, more agile machines can be programmed through simple graphical interfaces rather than complex proprietary code. Some can even be "trained" by having human operators guide their movements, like teaching a child how to tie their shoes.

For collaborative robots, if you just do a quick programming, then they can easily be reused for something else or for different tasks. It really minimizes the downtime as well as increases the flexibility of one machine so that it can be used for a variety of tasks.

The market for collaborative robots is expected to grow by 22 percent over the next 20 years, driven by their ability to adapt quickly to new tasks and production changes. This flexibility is crucial as automakers grapple with rapidly evolving vehicle technologies and fluctuating demand patterns.

Eyes and Brains: AI-Powered Vision Systems

Perhaps the most dramatic advancement in manufacturing robots is their ability to see and think. Traditional robots followed predetermined paths with military precision, but they were essentially blind. If a part was even slightly out of place, the robot would continue its programmed motion anyway, often resulting in errors or damage.

Modern robots equipped with AI-powered vision systems can actually see where parts are located and adjust their movements accordingly. It's the difference between a person walking with their eyes closed versus someone who can see and react to obstacles.

"The vision systems are better and all of these enabling technologies are improving AI machine vision," says

Jeff Burnstein, president of the Association for Advancing Automation. "This is allowing the robot to know actually where to pick up a part."

These systems are becoming sophisticated enough to identify defects, sort different types of components, and even predict when maintenance might be needed. The result is higher quality production with fewer errors and less waste.

The Humanoid Revolution

The most eye-catching development in automotive robotics is the emergence of humanoid robots that look and move like people. Companies like Tesla, Mercedes-Benz, BMW, and Hyundai are all experimenting with human-shaped robots that can perform tasks currently done by human workers.

Tesla CEO Elon Musk has been particularly bullish about humanoid robots, claiming his company's

Optimus robot could turn Tesla into a $25 trillion company. He expects "thousands of Optimus robots" by year's end, scaling to 1 million by the end of the decade.

Mercedes-Benz is testing Apptronik's Apollo robot in production facilities, with plans to have humanoid robots in production by around 2030. BMW has partnered with Figure to deploy humanoid robots at its Spartanburg, South Carolina factory.

The appeal of humanoid robots goes beyond their sci-fi factor. Because they're designed to work in environments built for humans, they require no factory modifications. They can use existing tools, navigate standard doorways, and work at human-height workstations.

The Economics Are Compelling: Manufacturing workers cost an average of $45.29 per hour in total compensation, while humanoid robots are projected to cost roughly $1.29 per hour at scale, according to venture capital firm UP.Partners.

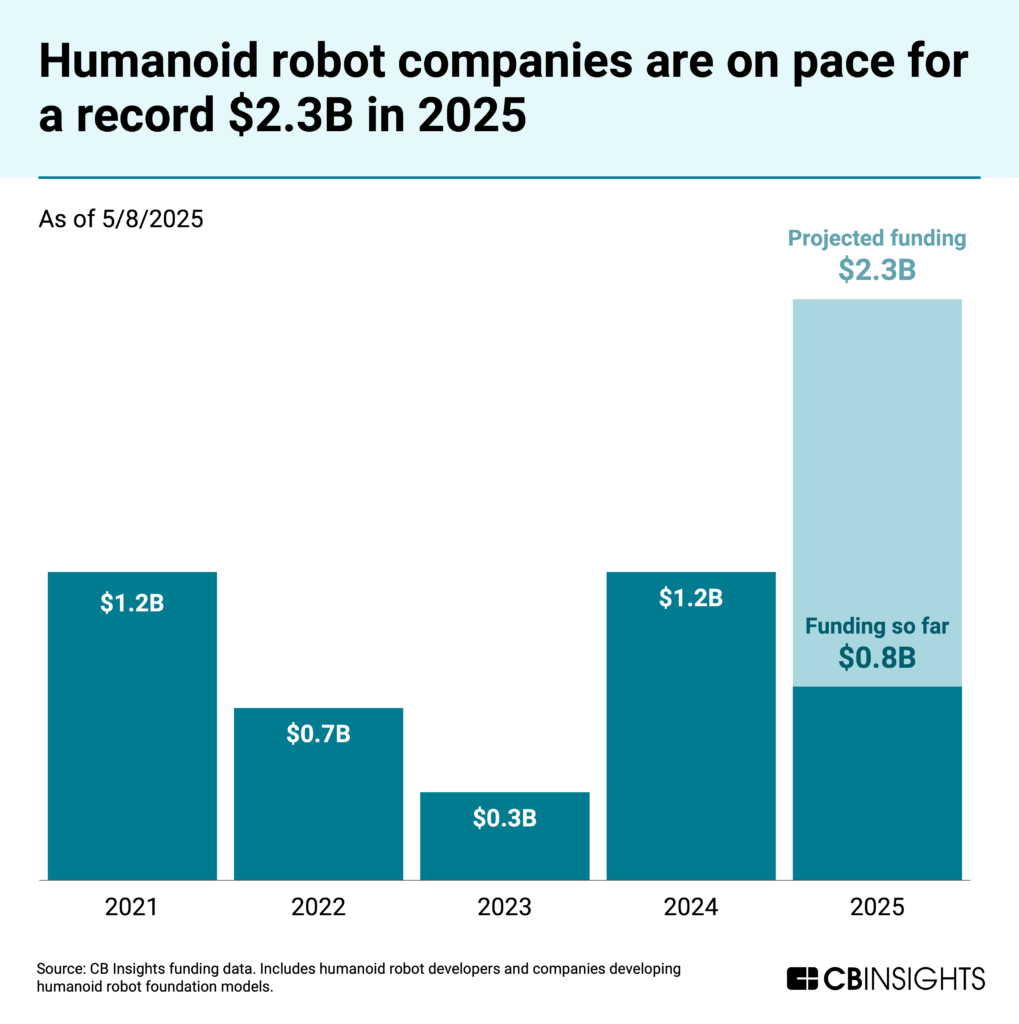

British consultancy IDTechEx estimates that around 1.6 million humanoid robots could be deployed in the automotive sector by 2035. Investors are taking notice,

pouring $1.2 billion into humanoid-focused companies in 2024, with expectations of $2.3 billion in 2025.

The Dark Factory Dream

The ultimate goal driving much of this robotic innovation is the concept of "dark factories" - manufacturing facilities that require so few human workers they could theoretically operate in the dark. It's a vision that has captivated manufacturers for decades but has remained frustratingly out of reach.

The push toward lights-out manufacturing isn't just about technological achievement. It's driven by practical concerns about labor shortages, rising labor costs, and the need to increase production capacity. Many North American auto plants currently operate at only 70 percent capacity utilization, well below the 80 percent target that companies prefer.

When automakers want to add production shifts to increase capacity, they often struggle to find skilled workers for key roles. "That's where a lot of vehicle manufacturers that may have capacity for two shifts and want to go to three realize there's a lack of a trained workforce, especially in skilled trades," explains Michael Robinet, vice president of forecast strategy at S&P Global Mobility.

However, industry experts caution that fully automated factories remain aspirational. "We are a ways out from being lights out," says Marie Szymanski, North American general manager of industrial assembly solutions at Atlas Copco. "Just realistically, we're not quite there yet."

Supply Chain Transformation

The robotics revolution is creating opportunities beyond just using robots in manufacturing. Automotive suppliers are repositioning themselves as robot component manufacturers, creating new revenue streams and helping boost factory utilization rates.

German drivetrain maker Schaeffler sees significant overlap between automotive components like bearings, gearboxes, and sensors, and the parts needed for humanoid robots. "We can provide these humanoid OEMs with the ability to scale to higher volumes," says David Kehr, Schaeffler's president of humanoid robotics. "We're a motion technology company, and what do humanoids do? They utilize motion. This is in our DNA."

This diversification strategy allows suppliers to leverage existing manufacturing capabilities while reducing dependence on volatile automotive demand cycles. It's a hedge against uncertainty while positioning companies for the next wave of technological growth.

The Global Competition

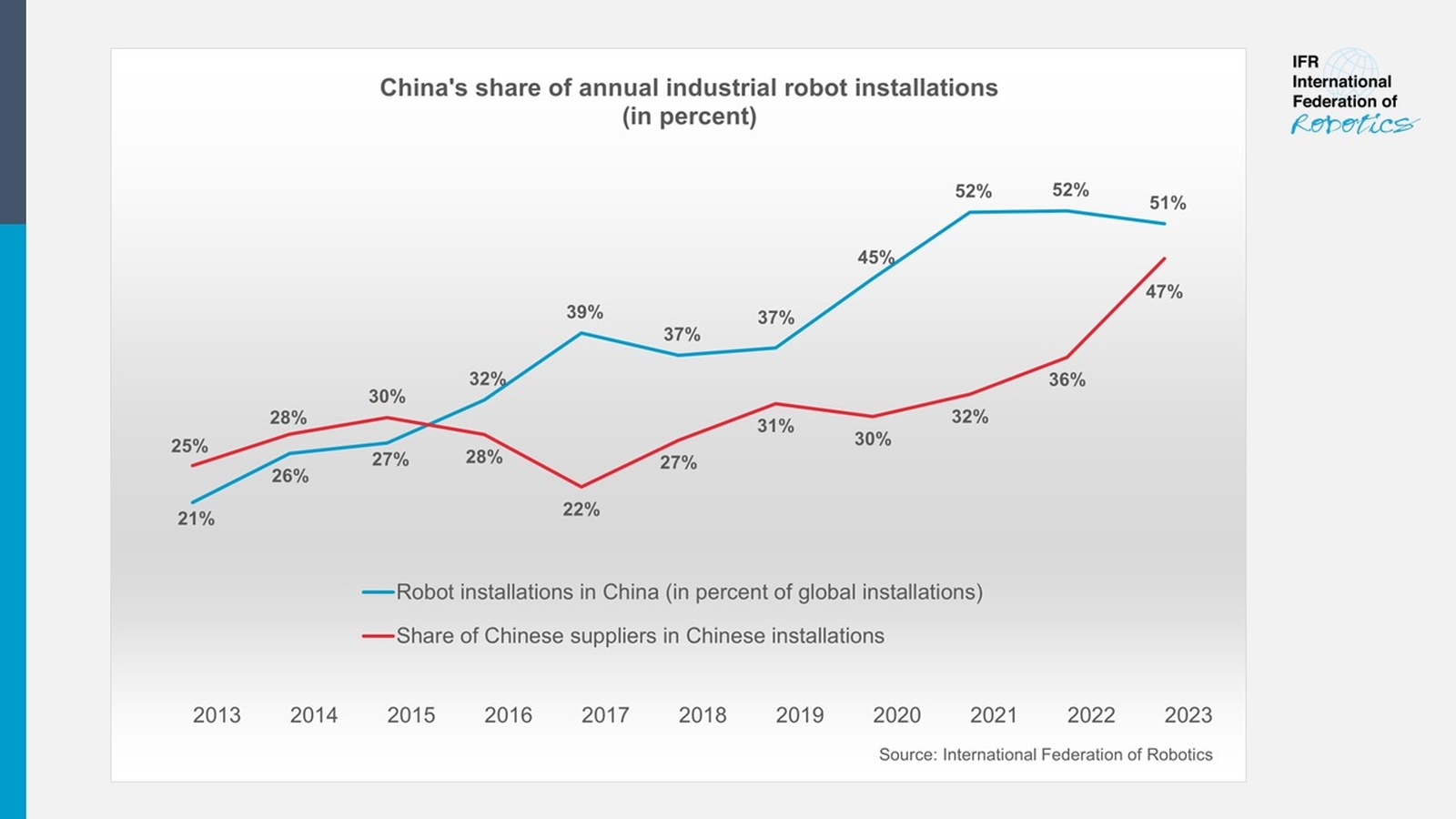

The robotics revolution in automotive manufacturing is happening against the backdrop of intensifying global competition, particularly between the United States and China. American robotics companies are pushing for a national robotics strategy to compete with China's coordinated approach to making intelligent robots a national priority.

China is currently the world's largest market for industrial robots, with about 1.8 million robots operating in 2023. The country has approved a

state-backed venture capital fund of $138 billion focused on robotics, AI, and other cutting-edge innovations.

Representatives from companies including Tesla, Boston Dynamics, and Apptronik recently met with U.S. lawmakers to advocate for policies that would boost American companies in the global robotics race. "The U.S. will not only lose the robotics race but also the AI race" without coordinated leadership, warned the Association for Advancing Automation.

The stakes are enormous. Morgan Stanley projects a

$4.7 trillion market for humanoid robots over the next 25 years - roughly double the cumulative revenues expected from the 20 largest global automakers in the same timeframe.

Challenges and Reality Checks

Despite the excitement and investment pouring into automotive robotics, significant challenges remain. The technology is still evolving, and the industry is "a couple breakthroughs" away from production scaling up to significant levels, according to Schaeffler's Kehr.

Manufacturing gearboxes for humanoid robots presents particular challenges, and questions remain about reliability, maintenance costs, and the complexity of integrating advanced robots into existing production systems.

Some industry observers remain skeptical about humanoid robots specifically. "We don't like humanoid robots very much because they're silly," says Bill Ray, a UK-based analyst for Gartner. "They look fantastic, but they're not very practical."

Ray argues that wheeled robots designed for specific tasks may prove more practical than human-shaped machines, even if they're less visually impressive.

The Human Factor

As robots become more capable and autonomous, questions about the role of human workers become increasingly important. While the technology promises to address labor shortages and reduce costs, it also raises concerns about job displacement.

Industry leaders generally maintain that humans will remain essential to manufacturing operations. "We don't envision a world in which people are out of the loop," says Burnstein from the Association for Advancing Automation. "I don't think you can effectively take advantage of these technologies without people."

The most likely scenario involves humans and robots working together in new ways, with people taking on more supervisory, creative, and problem-solving roles while robots handle routine physical tasks.

Companies that successfully navigate this transition will likely gain significant competitive advantages in cost, flexibility, and production capacity. Those that lag behind may find themselves struggling to compete in an increasingly automated world.

As

Hyundai's $21 billion U.S. investment and commitment to "tens of thousands" of robots demonstrates, the robot revolution in automotive manufacturing isn't coming - it's already here. The question isn't whether robots will transform the industry, but how quickly and how completely that transformation will occur.

Recent Posts